In late March 2020, the pandemic was beginning to grip the Western hemisphere. A few hundred miles away from the fashion capital of America, the head of United States Federal Reserve, Jerome Powell, had just appointed Larry Fink for a very big task, one that he had embarked on in 2008. As the CEO of BlackRock, the biggest wealth management firm in the world, Fink has an unusually cosy relationship with the Feds. Once again he found himself in bed with the central bank to bail out American corporations who were ‘too big to fail’. The Feds were about to turn on the money printer, and Fink’s job was to aim the nozzle. Somewhere in the firing line lay BlackRock’s subsidiary that stood to benefit in huge numbers. Conflict of interest you say? The Feds replied, it’s an emergency, there’s no time to think.

In this world of fiat currency (in which money is not backed by any tangible assets other than… trust, thanks to Richard Nixon terminating the Bretton-Woods Agreement), us common folk are at the mercy of the money printers. The world’s biggest money printer is none other than the United States Federal Reserve (aka America’s central bank), followed by its counterpart the European Central Bank. A responsible central bank controls the monetary policy to create a fair, well-managed economy that benefits the majority of the population while keeping the elite rentier class in check. What we are seeing now is the complete opposite.

The Feds decided that in order to buoy the economy at the start of the pandemic, it would inject cash into the monetary system. While ordinary Americans received a few thousand dollars in stimulus checks and a rent moratorium, Wall Street bankers, real estate, automotive, Big Tech, Big Oil and Big Pharma were granted billions of dollars through complex bond purchases, overseen by none other than BlackRock. Their reasoning was that monetary liquidity was necessary to keep the economy running during lockdown.

If the middle class received some spare change to buy a new bike, the elite class was given money to acquire assets that enriched them and their cronies by multiple folds.

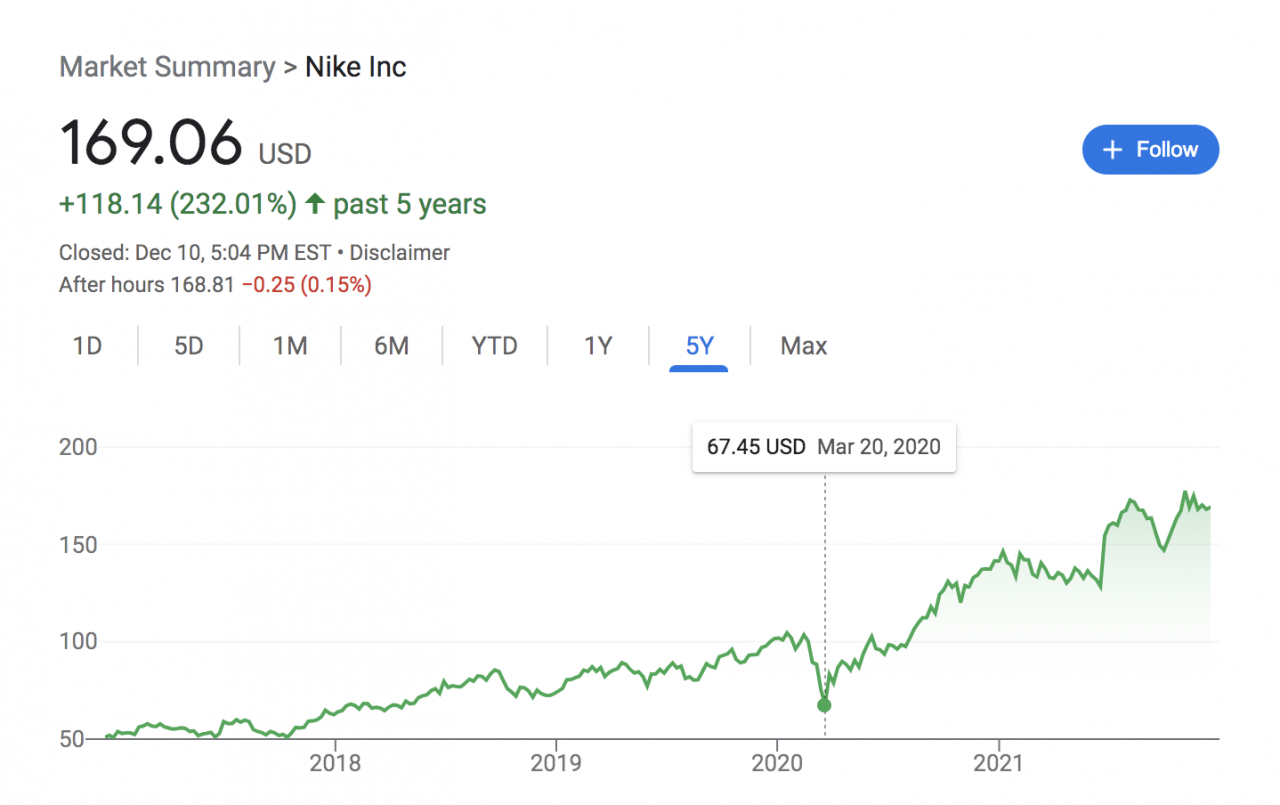

With bailout money that can only be accessed by the rentier class, fund managers (like BlackRock) invest this overflowing wealth in long-term assets and publicly-traded companies on behalf of their clients, thus raising share prices of the companies they have invested in. Within their giant portfolios are some household names in the apparel and footwear industry. As of today, BlackRock owns 4.62% of Nike’s shares while Vanguard owns 7.88%. Nike’s share price as of December 2021 has tripled since late March 2020, far beyond pre-pandemic numbers.

In VF Corp – the parent company that owns many outdoor brands we are familiar with such as Timberland and The North Face, and recently Supreme – both firms hold a roughly similar percentage of shares as that of Nike’s*. While the world was neck-deep in recession, VF Corp finalised the purchase of Supreme for $2.1 Billion. What a wonderful coincidence. With cash-infused BlackRock and Vanguard behind you, anything is possible. To make matters even more complicated, Vanguard and BlackRock also own shares in each others’ companies. It’s like a bloody orgy up there.

*Food for thought: When we promote Nike, we are complicit in enriching their shareholders who have a major part to play in inflating housing prices worldwide. Incidentally it is the vulnerable Nike-clad young generations who are being priced out of home ownership.

When the ECB buys bonds in the primary market it is essentially taking the place of some other investor who would have bought the bonds but cannot because the ECB bought them instead. That other investor still has money that it wants to invest but no more Apple or MacDonald’s (as an example) bonds to buy. So they have to use that money for some other investment. That is how the ECB pushes liquidity into the economy.

Erik Jones, professor of International Political Economy at Johns Hopkins University, told CNBC via email

Across the pond, the kings of luxury goods have also been bathing in the milk of cheap loans. The European Central Bank (ECB) has been relying on Quantitative Easing (which is the official term for money printing) since 2008 Great Recession by buying bonds from European corporations. In corp speak, ‘buying bonds’ is the same as giving loans, often at very low interest rates. Fast forward to 2020, the ECB returned with its money-printing rescue program known as PEPP, totalling 750 Billion Euro. Some of the chosen ones were (again) LVMH, Richemont and Kering**.

**Here’s a great website to track who received how much from which central bank

If you think that 2.1 Billion dollars for Supreme was ridiculous, it paled in comparison to how nepotistic the relationship is between ECB and European conglomerates. Compared to VF Corp who had to go through a song and dance via institutional investors to buy Supreme, LVMH was basically handed a pot of gold by the ECB. Through complex financial mechanism, Bernard Arnault was given a cheap loan package to buy Tiffany’s for US$16 Billion in the midst of a pandemic (please read this in detail and understand how the elites are given economic power and privileges). This money could have been used to buoy SME contractors and producers or build factories and create jobs post-pandemic while avoiding overinflation. Instead it was used to fatten an obese portfolio without adding real productivity to the economy. Small businesses tumbled as they were denied bank loans or had to rely on expensive credit to survive. Meanwhile, the big guns gained the blessings of the money-printing gods to enrich themselves further.

Over the course of 2020, the big winners saw their share prices and company valuations surging ever higher while the middle and working classes were beginning to feel the incoming tides of inflation. It’s taking adults far longer to stop believing in trickle-down economics than it took children to stop believing in Santa.

And here we are in 2021. A quick look at the fashion industry shows an ever-increasing homogeneity stretching as far as the eye could see. It is not difficult to fathom why.

The companies with the highest advertising budget – or are affiliated with those who do – hold the greatest influence over the masses. Backed by the power of unlimited money supply, big brands can surround consumers with their messaging 24/7, maximising exposure while crafting positive brand associations towards the brand. They buy your attention, manipulate your taste and control your purchases.

The moment Tiffany was acquired by LVMH, its marketing department got down to work immediately. Old brand associations made way for a brand new look. With the help of a cool New York-based celebrity couple, Tiffany attempts to replace its WASPy association with an edgy vibe, all in the name of attracting the younger crowd.

In a world crippled by fiat-driven economic inequality, existential crisis grew in leaps and bounds amongst the masses. The urge to rely on consumerism to soothe the troubled minds grows ever stronger. Brands – well aware of the problems they have exacerbated – offer the panacea in the form of Gore-Tex paraphernalia, branded sweaters, collab hoodies and accessible trinkets, ready to be paraded on phone screens. To be respected by fashion tribes on social media, one must don the right logos from the right seasons. Aesthetics, fit, materials and complexity of labour no longer matter as much. The proliferation of the swoosh, el-vee and double-G in real life and on social media is only to be expected. The logo – once a symbol for unique characteristics of a brand – has now become a promise for validation and an end to loneliness.

You might think you are buying into different companies, but they are increasingly owned by the select few. The barriers of entry for newcomers grow ever higher. Diversity of ideas is slowly being consolidated into oligarchies. Noone who wants to remain relevant is immune to this trend. Rick Owens knew this, that is why he partnered with Adidas, and now Converse – which is owned by Nike. Comme des Garçons does not shy away from collaborations, especially with Nike. And neither does Sacai, who at this point is just partnering with anyone they can grab hold of.

It’s a big club, and you ain’t in it.

George Carlin

As small producers, we are being priced out of labour and resources due to soaring inflation caused by money-printing, not to mention slowly losing competitive edge to the conglomerates. As consumers, we are losing diversity in tastes and perspective. There may be more brands than ever, but the range of styles and designs are ultimately dictated by the upper echelons. The what, why and when we consume are being shaped disproportionately by the oligarchies.

For those of us who work outside the system, we have to build our defenses against the incoming tide of watered-down homogeneity. For those of us who shop, we must understand where the desire to consume is coming from, and be aware of how our collective spending power can strengthen or slow down the solidification of oligarchies and their grip on our lives.

What are some of the things you can do to build up your defenses? After reading this it’s hard to not feel pessimistic about the long term outlook for brands like yours short of aggressive antitrust-type actions, and it’s really disheartening as someone who’s admired your design work for years now.